ORO Impact, a social impact fintech company, has launched a revolutionary down payment assistance (DPA) platform that aims to transform homeownership throughout the United States. ORO Impact’s customizable platform makes it easy for employers to make loans to their employees, which the employees can use to make down payments on homes and realize the dream of homeownership while providing a high-impact retention incentive for employers.

ORO Impact, a social impact fintech company, has launched a revolutionary down payment assistance (DPA) platform that aims to transform homeownership throughout the United States. ORO Impact’s customizable platform makes it easy for employers to make loans to their employees, which the employees can use to make down payments on homes and realize the dream of homeownership while providing a high-impact retention incentive for employers.

As the 401(k) plan revolutionized retirement savings – offered today to 69% of private sector employees and 92% of government employees – ORO Impact aims to do the same for homeownership.

ORO Impact addresses two national challenges: down payment affordability has put homeownership outreach for many Americans, and employee tenure is at record lows as employers struggle to attract and retain employees.

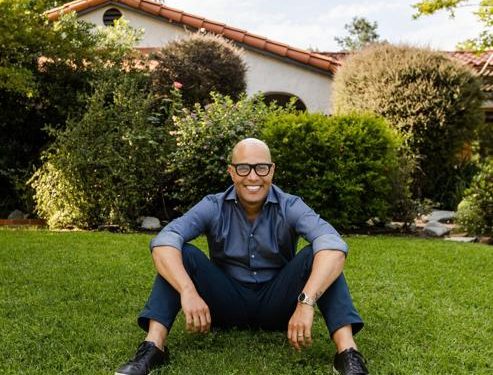

ORO Impact is the brainchild of George Fatheree III, a history-making attorney turned social impact entrepreneur. Fatheree is most notably recognized for securing the 2022 landmark return of the Bruce’s Beach property, an African-American beach resort in Manhattan Beach, California – marking the first time in U.S. history that the government has returned property taken by racially motivated eminent domain.

Strategic Partnership, Liberty Bank & Trust

ORO Impact has partnered with Liberty Bank & Trust, one of the largest Black-owned banks in the country with over $1 billion in assets. Liberty Bank will serve as one of ORO Impact’s preferred lending partners. “Liberty Bank is proud to partner with ORO Impact in the launch of its innovative platform to help remove down payment affordability as a barrier to homeownership,” said Todd McDonald, President of Liberty Bank & Trust.

Helping Employers, Helping Employees

By helping employers extend down payment assistance to employees, employers benefit from lower retention costs, and employees can begin building wealth quicker. ORO Impact also offers home buyers access to credit repair and other first time home buyer resources.

Addressing Wealth Disparities

Homeownership reflects racial inequity, with homeownership rates for African American and Latino households lagging the national median by 22% and 15%, respectively. In many parts of the country, African American homeownership rates are lower today than in the 1960s, when housing discrimination based on race was legal.

For more information visit www.oroimpact.com.

ORO Impact, a social impact fintech dedicated to closing the wealth gap, is revolutionizing access to homeownership through its down payment assistance platform and providing solutions for employers to improve employee retention. Visit www.oroimpact.com.

George Fatheree III, founder/CEO of ORO Impact and history-making attorney, is most notable for securing the landmark return of the Bruce’s Beach property and representing a consortium of nonprofits acquiring the Ebony/Jet magazine photography archives from bankruptcy. A sought-after public speaker, he’s keynoted panels for corporate, government and nonprofit organizations across the country, including his alma maters Harvard University and Loyola Marymount University. Visit www.georgefatheree.com.